How does extending battery duration impact revenues?

FlexPlum Team

•

April 28, 2025

This time, we’re not writing about our model battery – we want to show what choices an investor faces when deciding on the energy capacity and duration of a battery storage system.

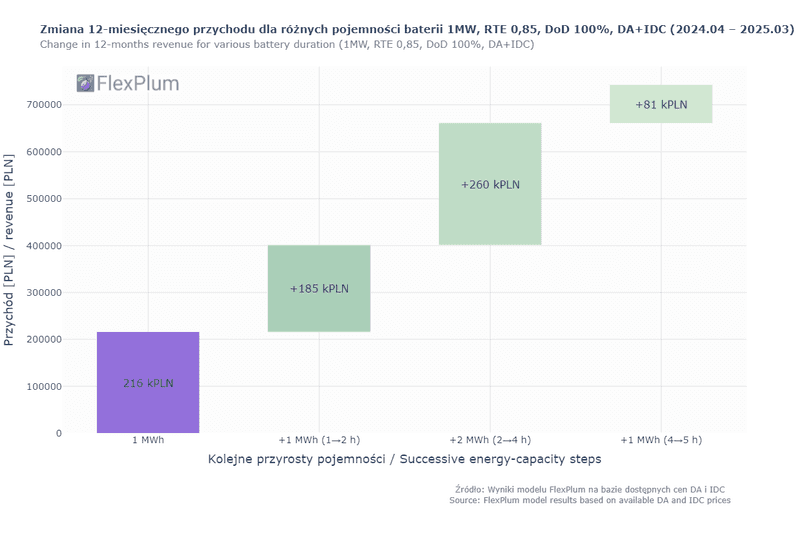

The chart shows the change in 12-month revenue for a 1 MW battery across different durations (RTE 0.85, DoD 100%) between April 2024 and March 2025.

📊 What do the results show?

- Operation for 1h (1 MWh) → 216k PLN during the analyzed period

- Extending to 2h → revenue increases by +86%

- Extending from 2h to 4h → another +63% increase

- Extending from 4h to 5h → +13% increase

🔍 Conclusion:

Each additional MWh of installed capacity (with unchanged power output) brings a smaller incremental revenue increase.

The most significant jump occurs when extending to 4h – further increases yield diminishing returns.

Choosing the optimal battery duration is key to a successful investment – decisions should be based on solid, data-driven analysis.

Want to find out which configuration would be optimal for your project, taking into account various revenue streams?

📩 Get in touch: contact@flexplum.com

Tell us what you think!

We warmly invite you to visit our LinkedIn profile and share your thoughts in the comments under our latest post:

How does extending battery duration impact revenues?

#EnergyStorage #BatteryStorage #FlexPlum #BESS #Poland #Optimization #Revenue #EnergyMarket #MagazynEnergii #Magazyn Energii #Optymalizacja magazynu energii #Przychody z magazynu energii #OptymalizacjaMagazynuEnergii #PrzychodyZMagazynuEnergii #Dofinansowanie nfosigw #NFOŚiGW #BatteryDuration #2h #4h

© 2025 FlexPlum. All rights reserved.