November 2025 – less volatility, less revenue

FlexPlum Team

•

December 04, 2025

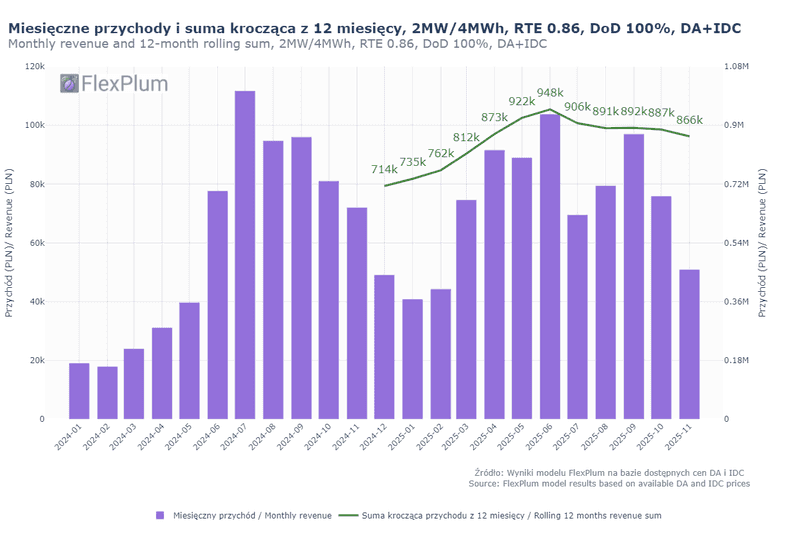

Our model battery (2 MW, 4 MWh, RTE 0.86, DoD 100%), optimized for DA + IDC, could have generated 51 kPLN in revenue – that’s 30% less than in November 2024 and a 50% drop from the record-breaking July 2025

November came with higher prices... but lower volatility – and that’s not necessarily good news for battery energy storage systems. 📉

📊 The 12-month rolling sum dropped again – now at 866 kPLN.

🟡 From a Q4 perspective, 2025 is clearly underperforming compared to 2024:

- October was down 7% y/y

- November down by as much as 30%

Tell us what you think!

💬 Will December reverse the trend? Or is Q4 2025 shaping up to be the weakest quarter of the year? Share your thoughts in the comments!

We warmly invite you to visit our LinkedIn profile and share your thoughts in the comments under our latest post:

November 2025 – less volatility, less revenue

#EnergyStorage #Listopad2025 #FlexPlum #BESS #Optimization #Revenue #Poland #MarketReform #November2025 #RollingRevenue #12MonthSum #NFOŚiGW #BatteryFunding #CashflowAnalysis #MagazynEnergii #Magazyn Energii #Optymalizacja magazynu energii #Przychody z magazynu energii #OptymalizacjaMagazynuEnergii #PrzychodyZMagazynuEnergii #Dofinansowanie nfosigw #NFOŚiGW #Colocated #Kolokacja #BESS+PV #ExtremeImbalancePrice #balancingPricePoland #15minSettlement #FixingII #SDAC #BESSInsights

© 2025 FlexPlum. All rights reserved.