October 2025 - stability and signals from the balancing market

FlexPlum Team

•

November 10, 2025

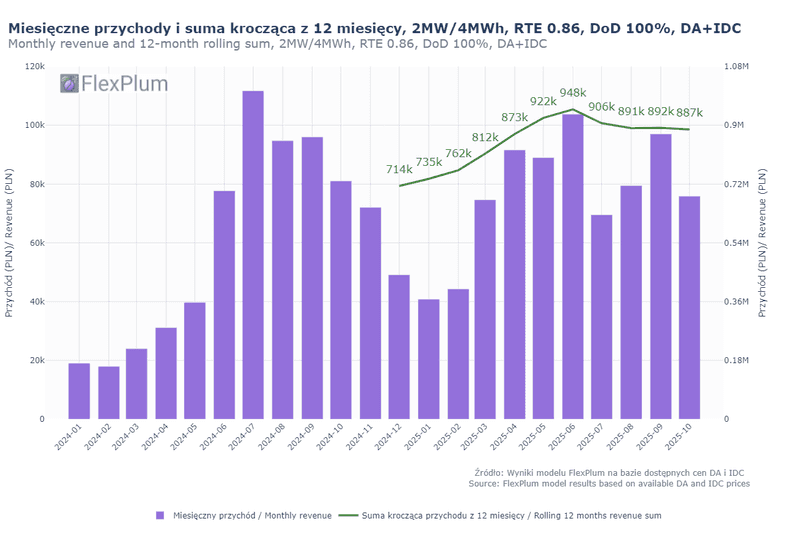

Our model battery (2 MW, 4 MWh, RTE 0.86, DoD 100%) could have generated 76 kPLN in revenue from DA + IDC optimization in October. That’s 22% less than in September, but still aligned with seasonal trends.

📉 The average daily revenue was 2,449 PLN, and the 12-month rolling sum remained stable at 887 kPLN - the third consecutive month without major changes in this indicator. What does it mean? We’re starting to see some seasonal patterns in BESS financial performance.

⚠️ Anomalies on the balancing market

October also brought an exceptional event on the balancing market: during massive RES curtailments (up to 2 GW taken offline), a positive imbalance price of nearly 39,500 PLN/MWh was recorded - this time over two quarter-hours! For batteries offering upward capacity in the aFRR up product, this was a perfect opportunity to secure high earnings - and a strong argument for diversifying revenue strategies beyond DA and IDC.

Tell us what you think!

💬 Do you think October confirms a stabilization trend in BESS revenues? Share your thoughts in the comments!

We warmly invite you to visit our LinkedIn profile and share your thoughts in the comments under our latest post:

October 2025 - stability and signals from the balancing market

#EnergyStorage #Październik2025 #FlexPlum #BESS #Optimization #Revenue #Poland #MarketReform #October2025 #RollingRevenue #12MonthSum #NFOŚiGW #BatteryFunding #CashflowAnalysis #MagazynEnergii #Magazyn Energii #Optymalizacja magazynu energii #Przychody z magazynu energii #OptymalizacjaMagazynuEnergii #PrzychodyZMagazynuEnergii #Dofinansowanie nfosigw #NFOŚiGW #Colocated #Kolokacja #BESS+PV #ExtremeImbalancePrice #balancingPricePoland #15minSettlement #FixingII #SDAC #BESSInsights

© 2025 FlexPlum. All rights reserved.