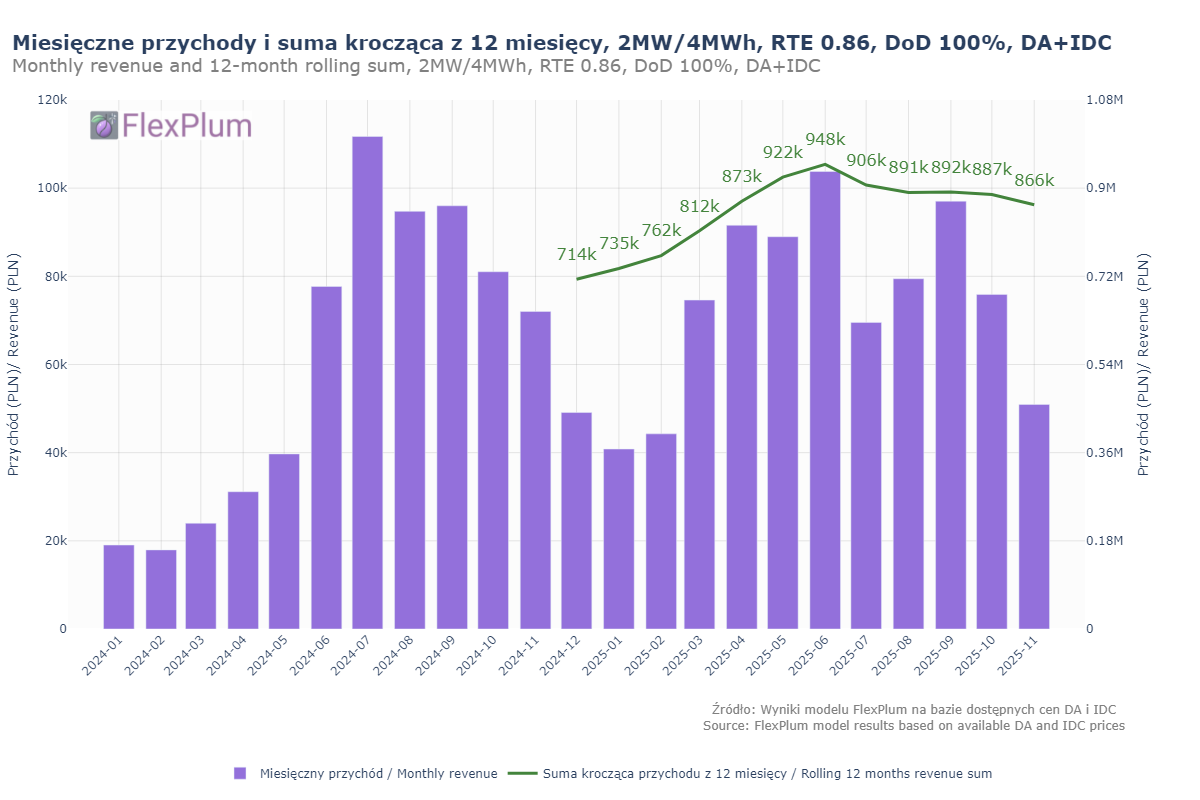

November 2025 – less volatility, less revenue

Our model battery (2 MW, 4 MWh, RTE 0.86, DoD 100%), optimized for DA + IDC, could have generated 51 kPLN in revenue – that’s 30% less than…

FlexPlum Team

•

December 04, 2025

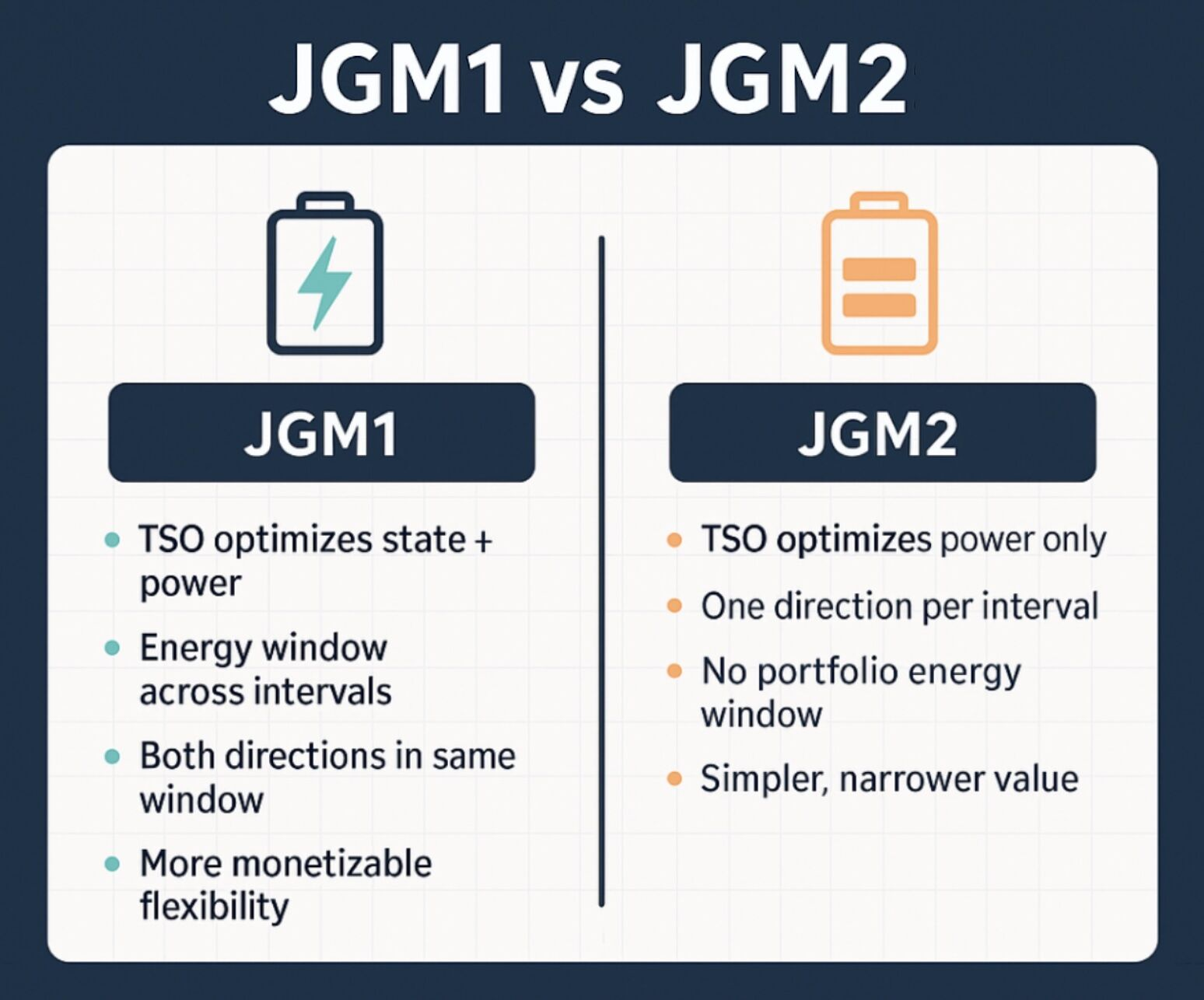

JGM1 or JGM2 - How TSO codes shape your flexibility

JGM1 and JGM2 are TSO-assigned codes that define how your BESS can be used to deliver ancillary services. Here’s a quick summary of nuanced…

FlexPlum Team

•

November 25, 2025

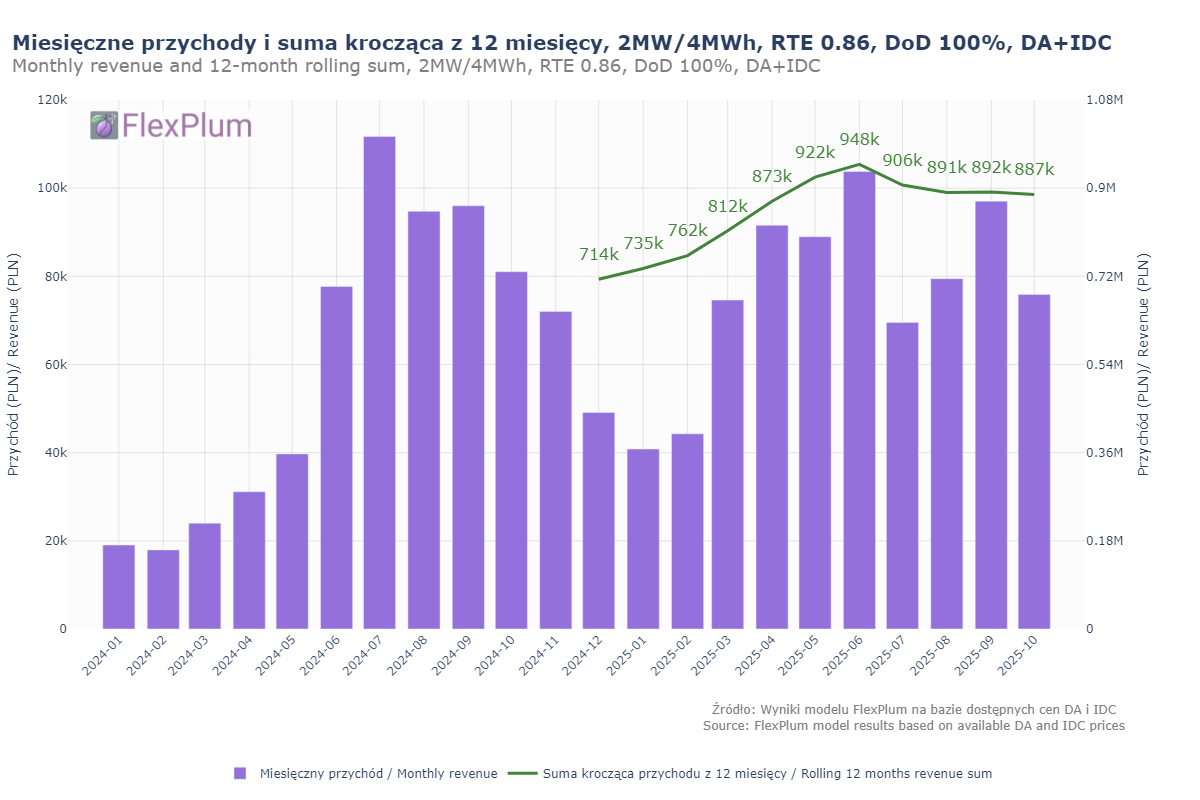

October 2025 - stability and signals from the balancing market

Our model battery (2 MW, 4 MWh, RTE 0.86, DoD 100%) could have generated 76 kPLN in revenue from DA + IDC optimization in October. That’s 2…

FlexPlum Team

•

November 10, 2025

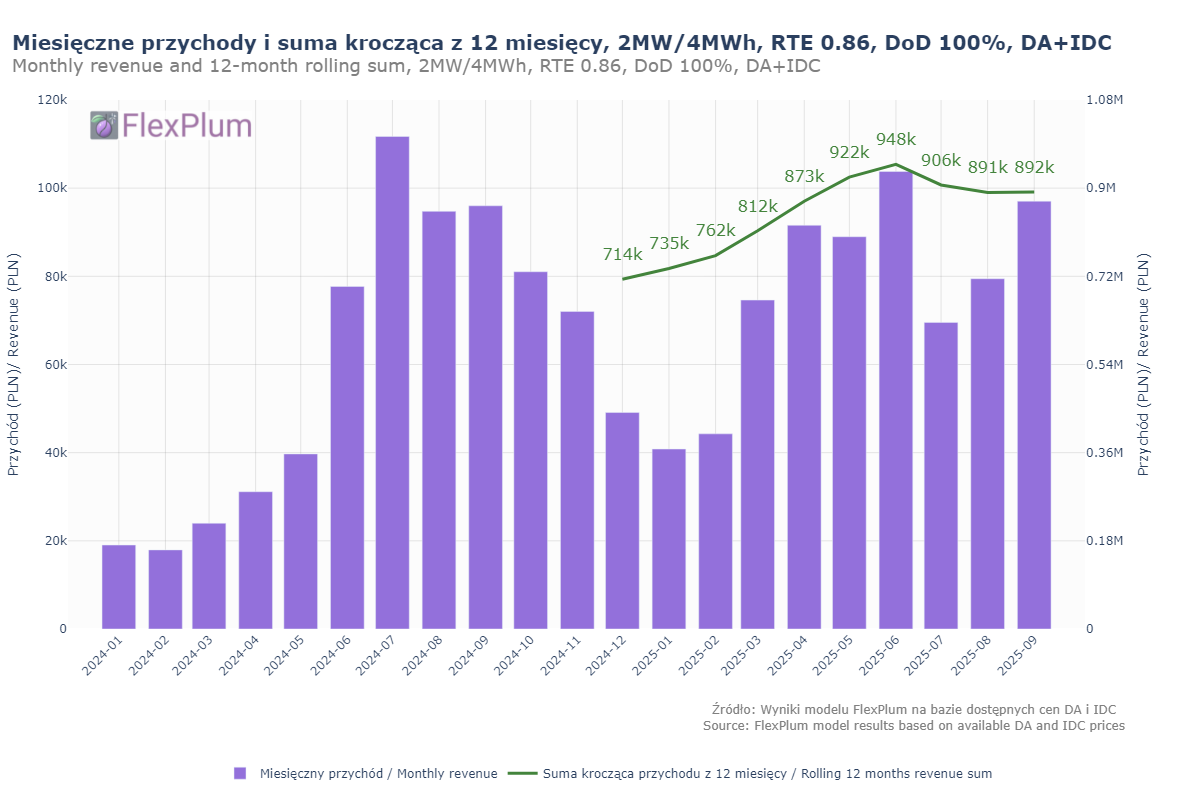

September 2025 - second-best opportunity this year

Our model battery (2 MW, 4 MWh, RTE 0.86, DoD 100%), optimized for DA + IDC, could have earned 97 thousand PLN - the second-highest result…

FlexPlum Team

•

October 04, 2025

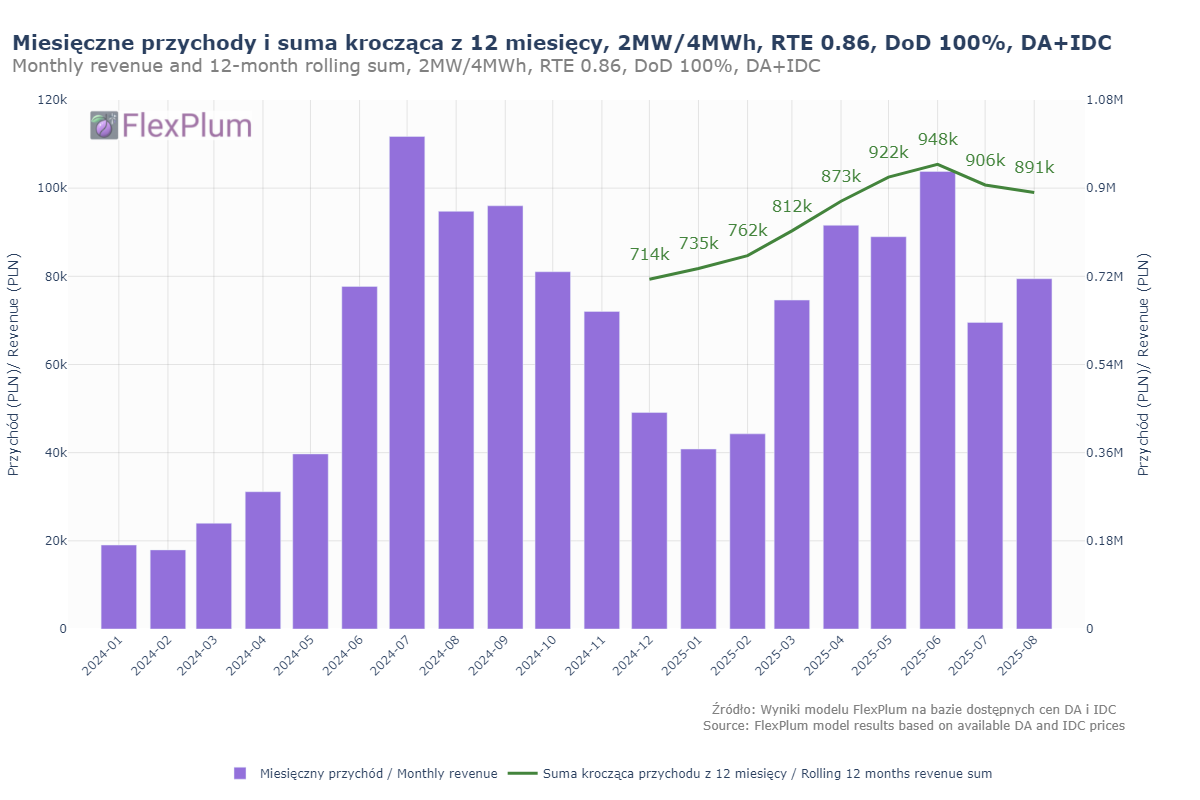

August 2025 - slight rebound, but the downward trend continues

Our model battery (2 MW, 4 MWh, RTE 0.86, DoD 100%) could have generated 79 kPLN in revenue this August – 14% more than in July. 📉 However…

FlexPlum Team

•

September 04, 2025

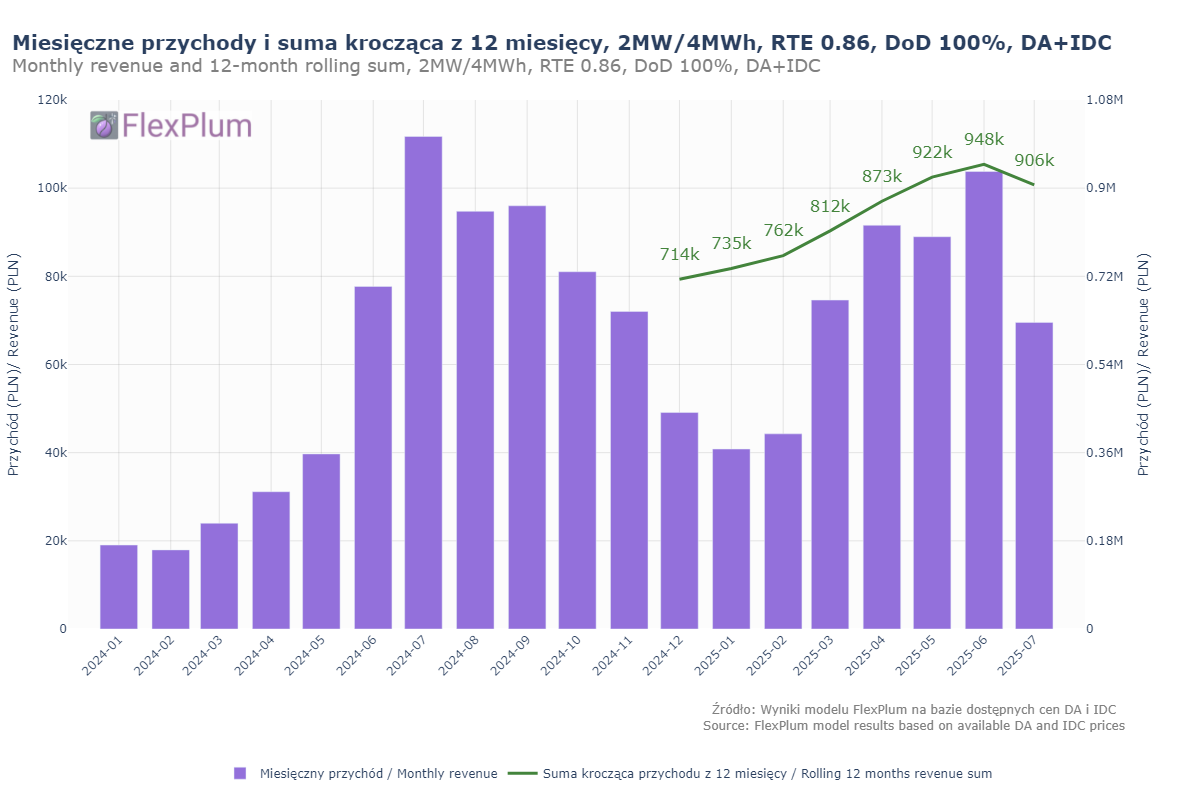

July 2025 - a sharp correction after a record-setting June

After a very strong June, July brought an unexpected cooldown - the average daily revenue of our model battery (2 MW, 4 MWh, RTE 0.86, DoD…

FlexPlum Team

•

August 06, 2025

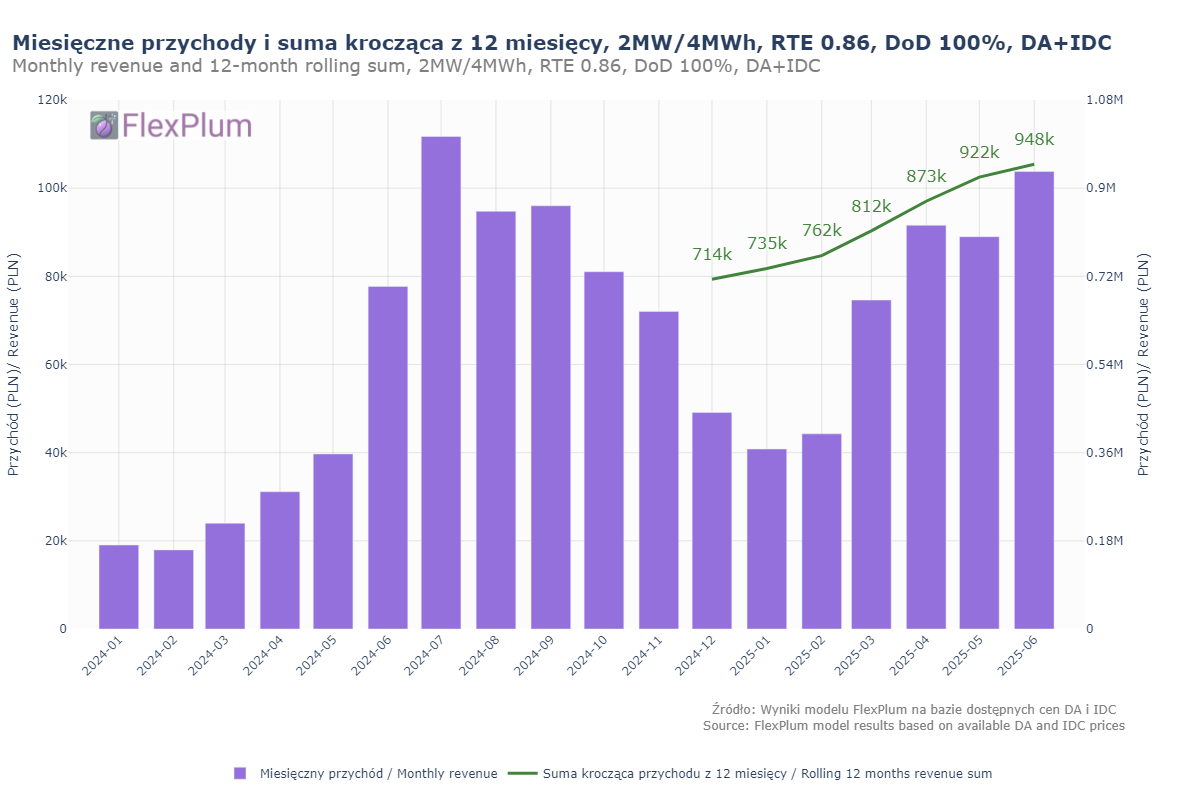

June 2025 – a new record!

Our model battery (2 MW, 4 MWh, RTE 0.86, DoD 100%) generated on wholesale optimization an average daily revenue of 3460 PLN, which is 1…

FlexPlum Team

•

July 04, 2025

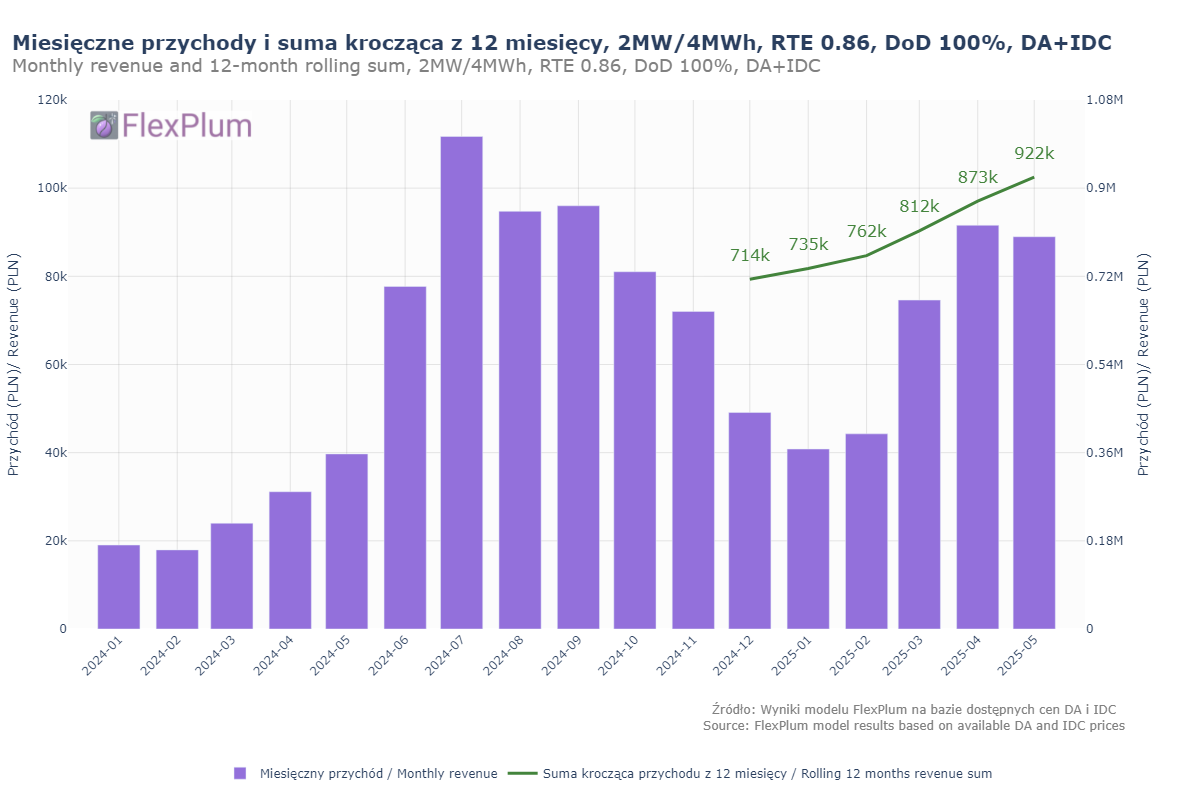

May 2025 - a slight correction after April’s peak?

The average daily revenue of our model battery (2 MW, 4 MWh, RTE 0.86, DoD 100%) in May was 2,871 PLN – 6% lower than in April, but still a…

FlexPlum Team

•

June 04, 2025

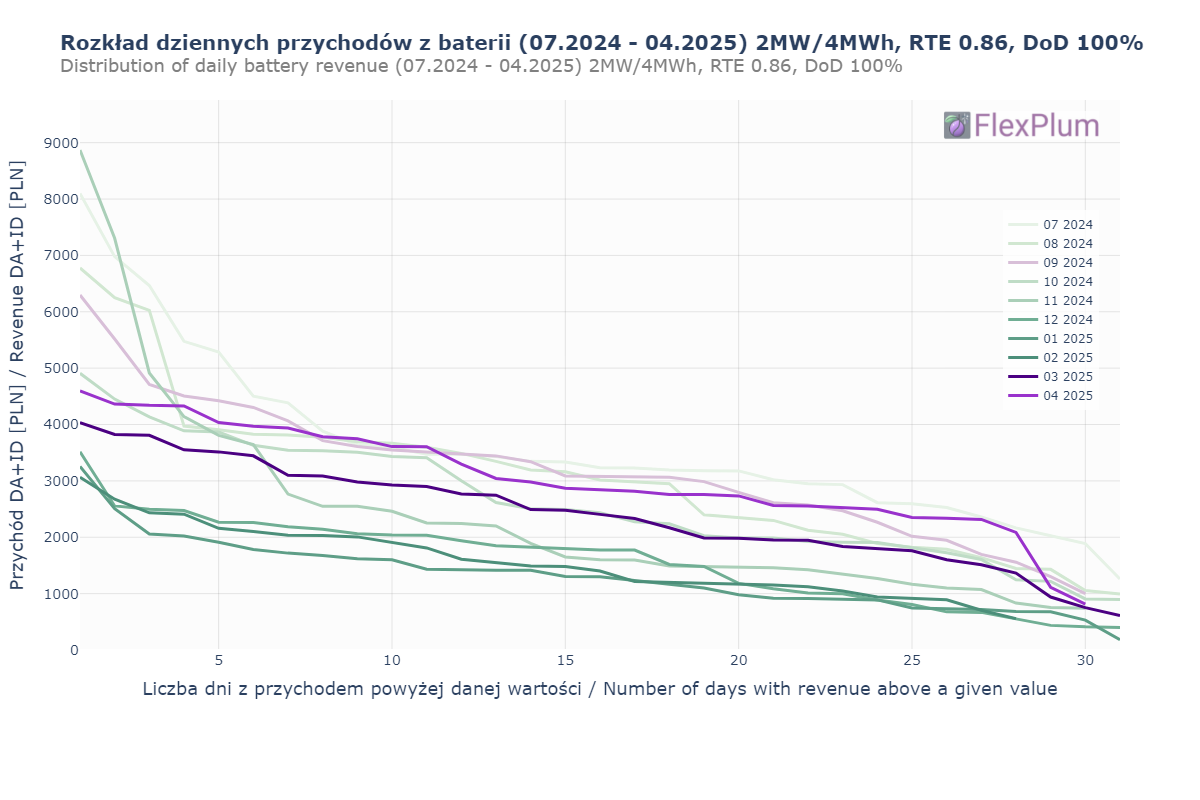

One more look at April 2025 – stable and predictable?

In March, revenue from our model battery (2MW, 4MWh, RTE 0.86, DoD 100%) was evenly distributed across the month – and April seems to…

FlexPlum Team

•

May 12, 2025

April 2025 - 27% better average daily revenue than in March!

March was a strong month for BESS, but April outperformed it. The average daily revenue from DA + IDC optimization for our model battery…

FlexPlum Team

•

May 05, 2025

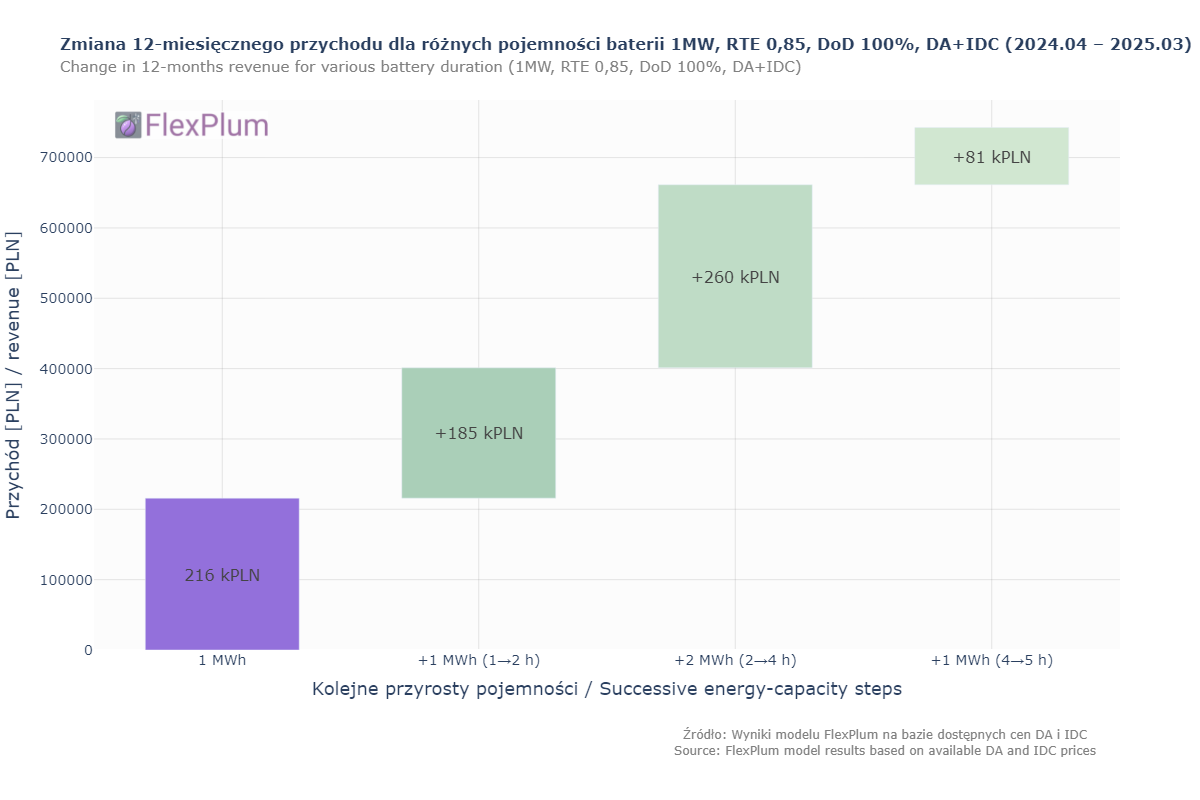

How does extending battery duration impact revenues?

This time, we’re not writing about our model battery – we want to show what choices an investor faces when deciding on the energy capacity…

FlexPlum Team

•

April 28, 2025

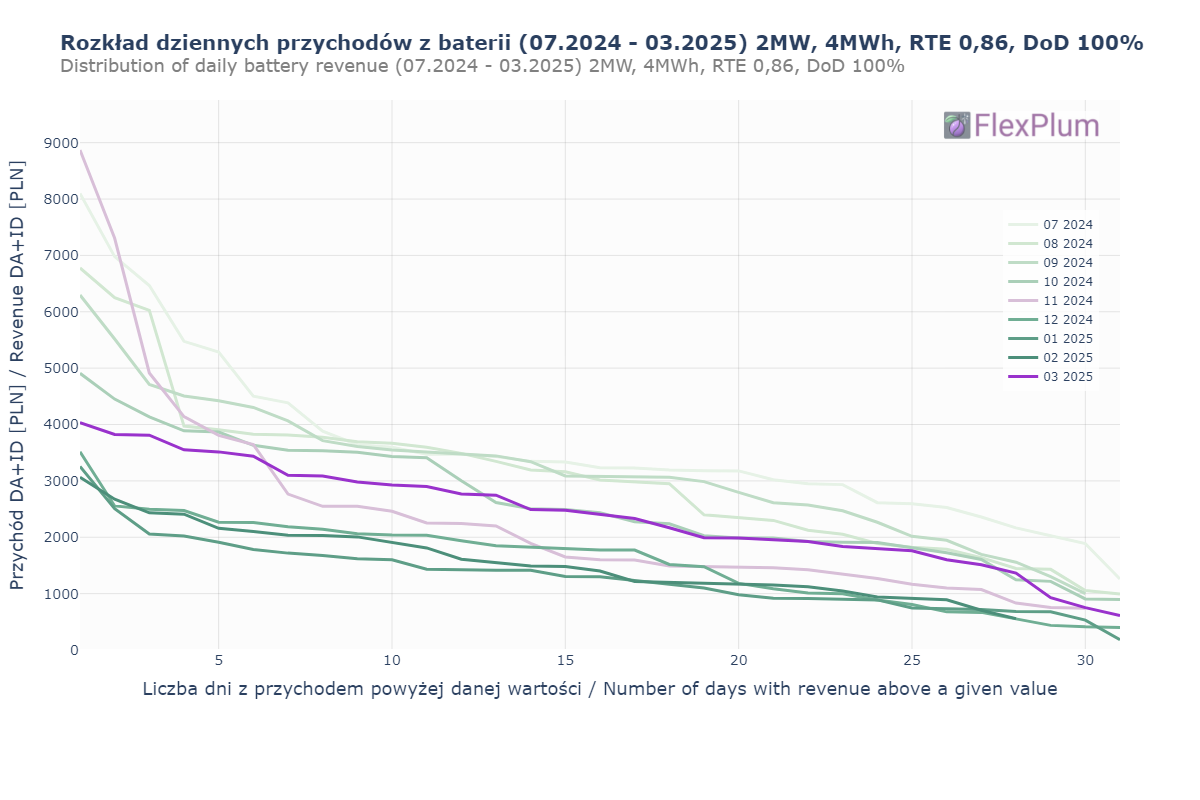

March 2025 vs November 2024 – similar revenues, but a completely different distribution!

In our last post, we noted that the monthly DA+ID revenue of our model battery (2 MW, 4 MWh, RTE 0.86, DoD 100%) in March was similar to…

FlexPlum Team

•

April 22, 2025

March 2025 – it was supposed to be better and it was!

As anticipated in our previous post from the series (Feb 2025 ), March brought a significant increase in revenues from our model battery (…

FlexPlum Team

•

April 14, 2025

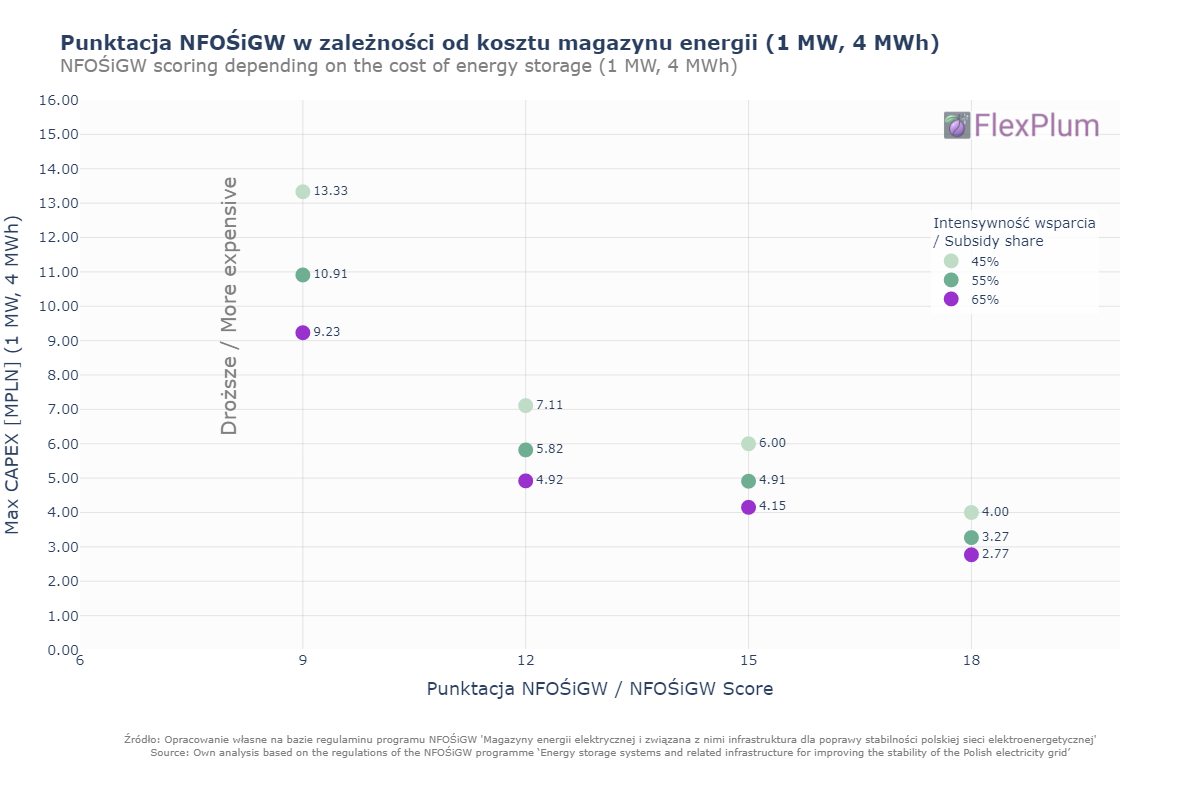

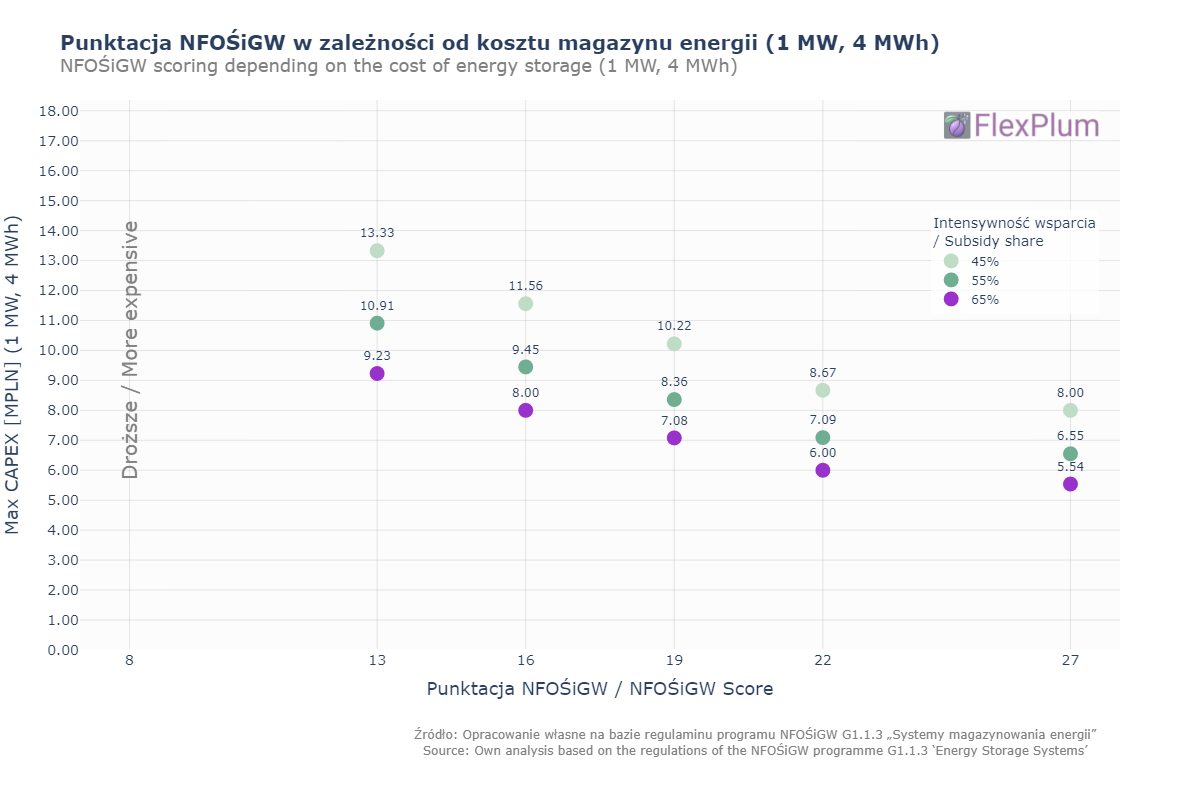

NFOŚiGW subsidy call is open! – how much can a battery cost to score the maximum number of points?

In one of our previous posts, we explained how the G1.1.3 program scores applications based on cost per 1 MW and 1 MWh. The same criteria…

FlexPlum Team

•

April 07, 2025

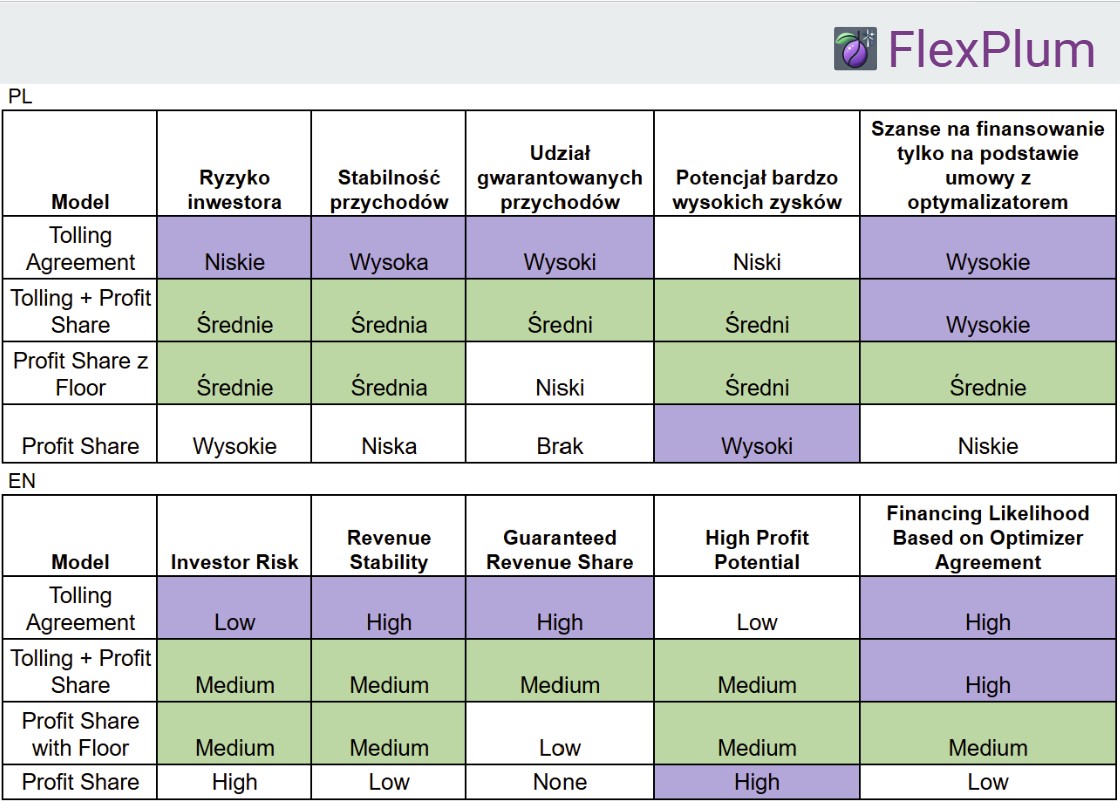

Investor risk vs. Partnership model with an Optimizer

Every agreement is a balance between the potential for high profits and ensuring security and revenue stability. The choice of cooperation…

FlexPlum Team

•

March 24, 2025

NFOSiGW subsidy vs. Capacity Market – The benefits can be combined, but not stacked!

Among investors, there are many questions about whether NFOŚiGW funding can be combined with Capacity Market revenues. To clear up any…

FlexPlum Team

•

March 17, 2025

February 2025 - Is the trend finally reversing?

We finally have a rebound! Key takeaways: While the maximum daily revenue of our model battery (2 MW, 4 MWh, RTE 0.86) in February was lower…

FlexPlum Team

•

March 10, 2025

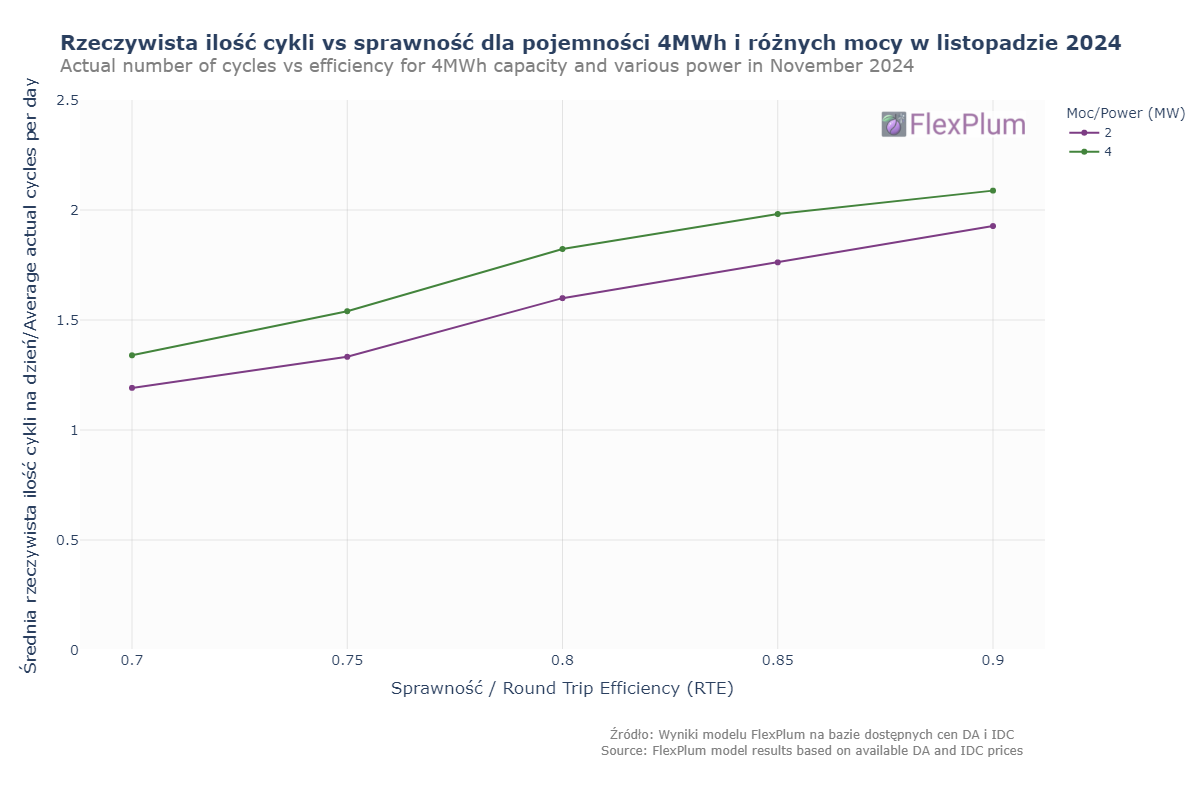

How many daily cycles should an BESS perform to maximize revenue?

BESS investors often seek a balance between maximizing revenue and maintaining battery longevity. This raises the question: what is the…

FlexPlum Team

•

March 03, 2025

BESS Glossary – Navigating Common Terms & Assumptions

As the energy storage industry continues to expand in Poland, more and more calculations and analyses are popping up online. You might have…

FlexPlum Team

•

February 22, 2025

NFOSiGW subsidy – What is the maximum BESS cost to achieve the highest score in the application assessment?

NFOSiGW has announced a call for applications for energy storage funding (subsidy for BESS in Poland) under the G1.1.3 "Energy Storage…

FlexPlum Team

•

February 15, 2025

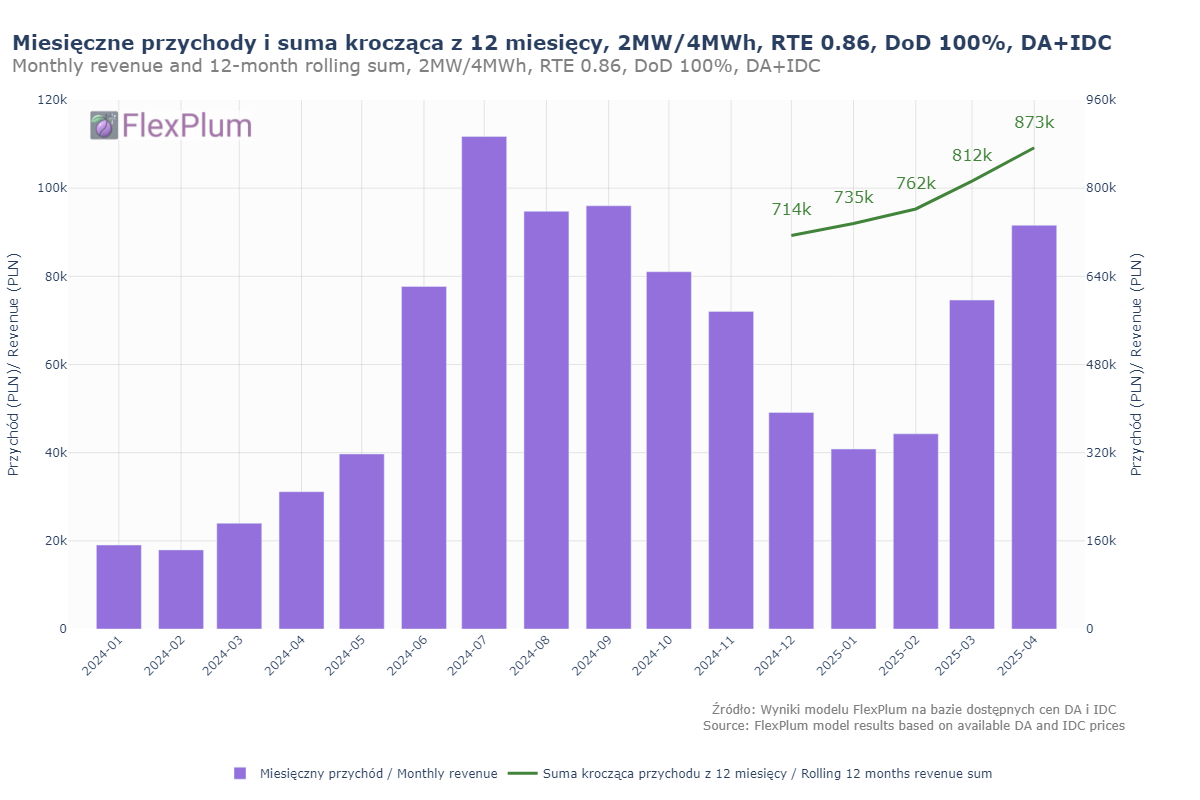

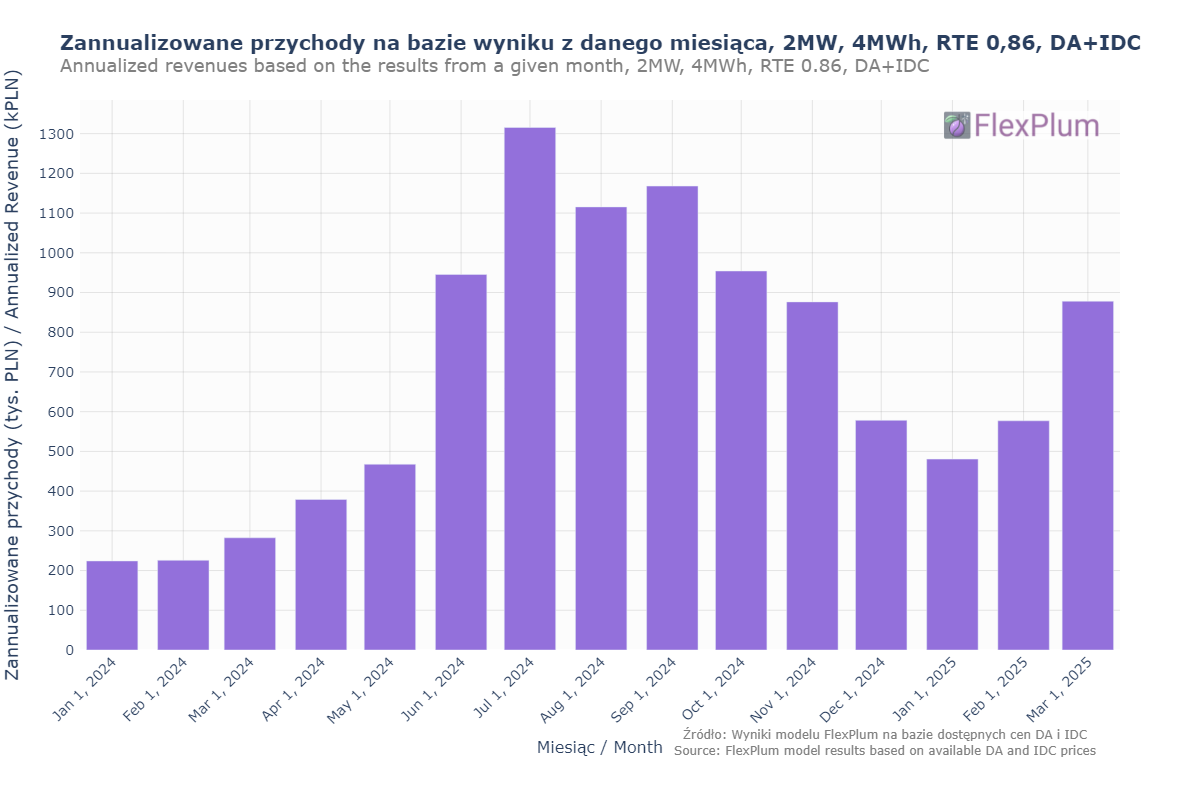

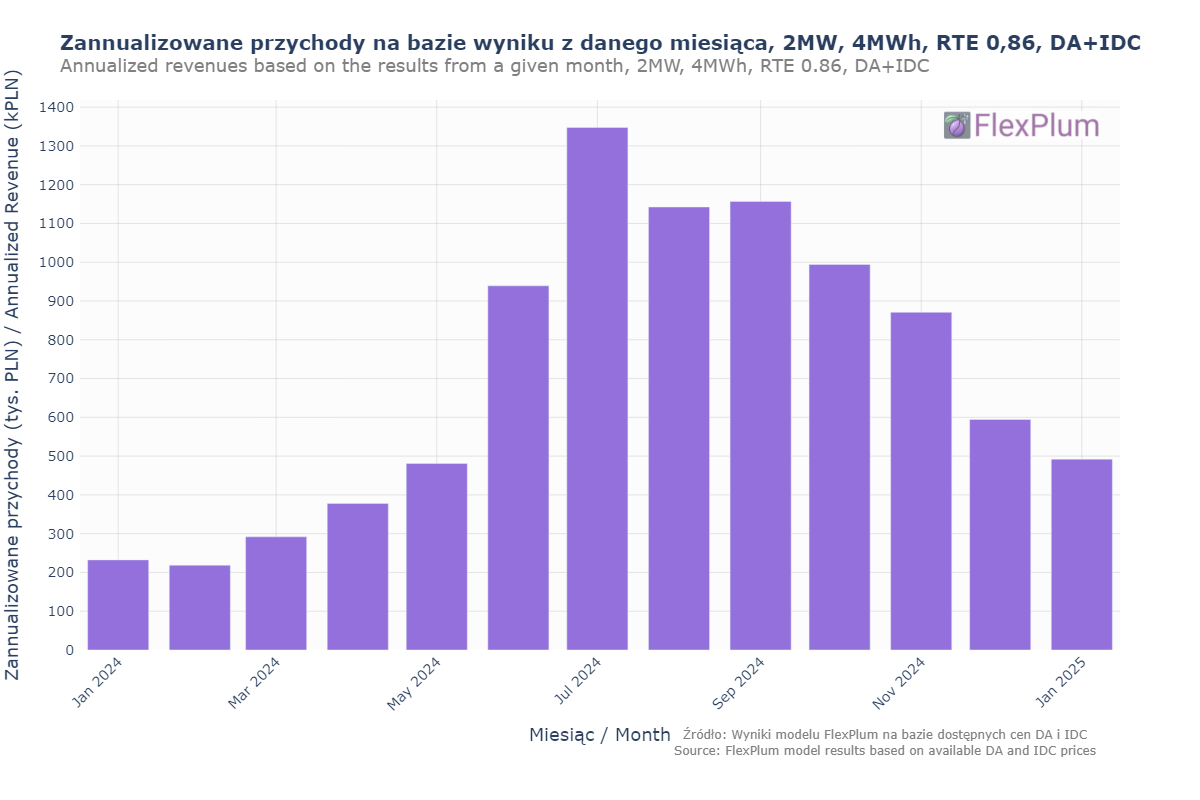

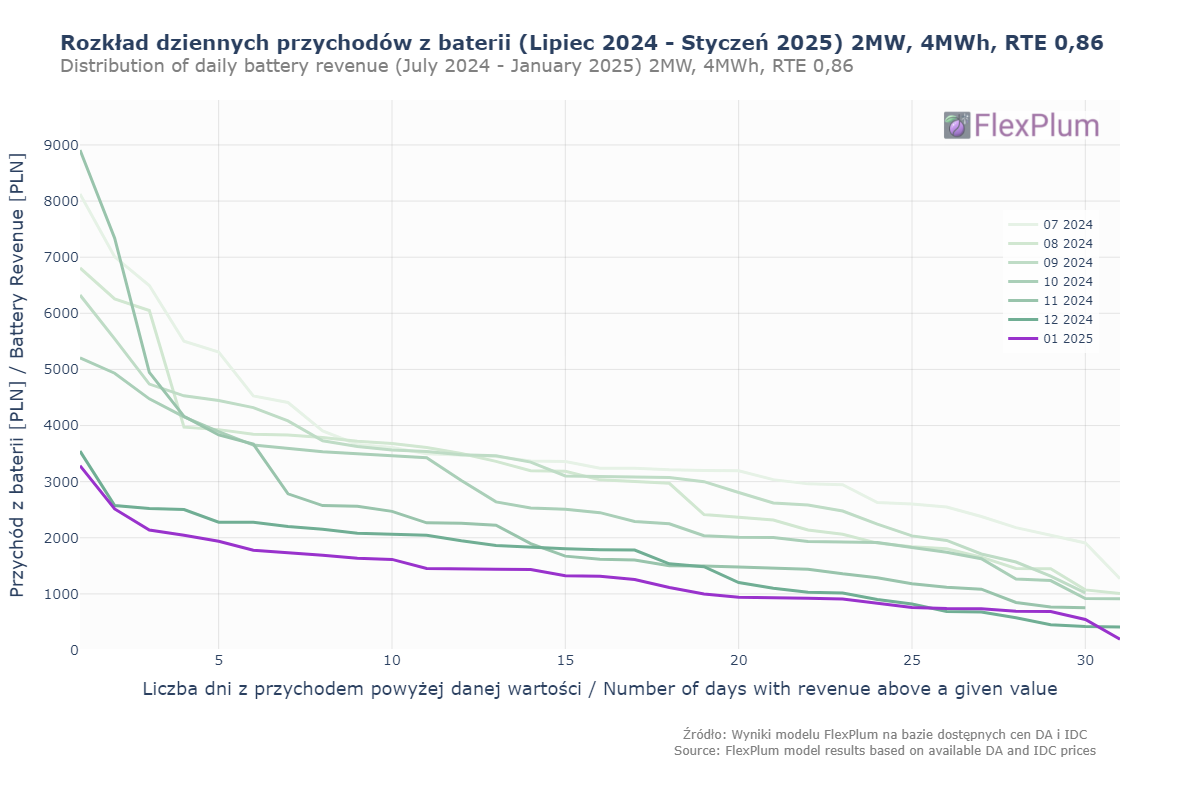

Annualized battery revenues from Jan 2024 to Jan 2025

This time, instead of analyzing individual days, we’re looking at monthly results and how they would translate into the battery’s annual…

FlexPlum Team

•

February 10, 2025

January 2025 – our model battery’s results are in!

January data confirms the trend we’ve seen in previous months – revenues from the wholesale market for our model battery (2 MW, 4 MWh, RTE…

FlexPlum Team

•

February 03, 2025

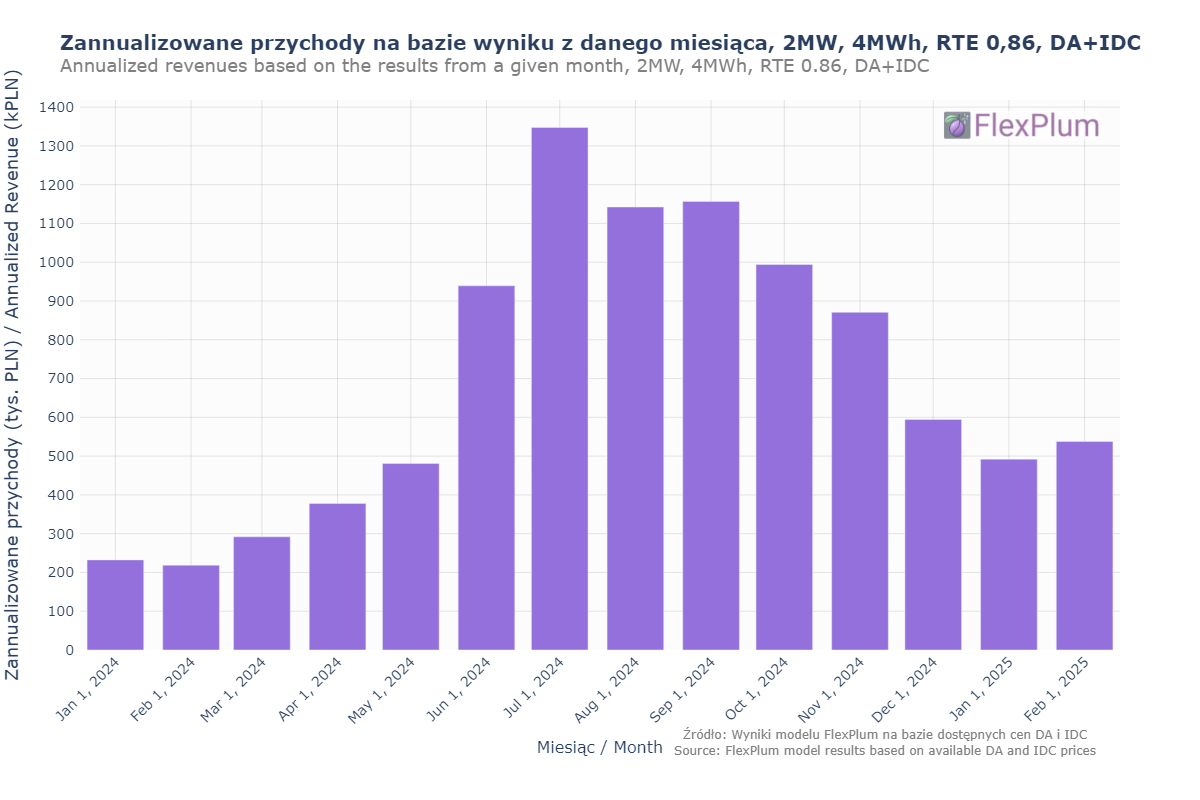

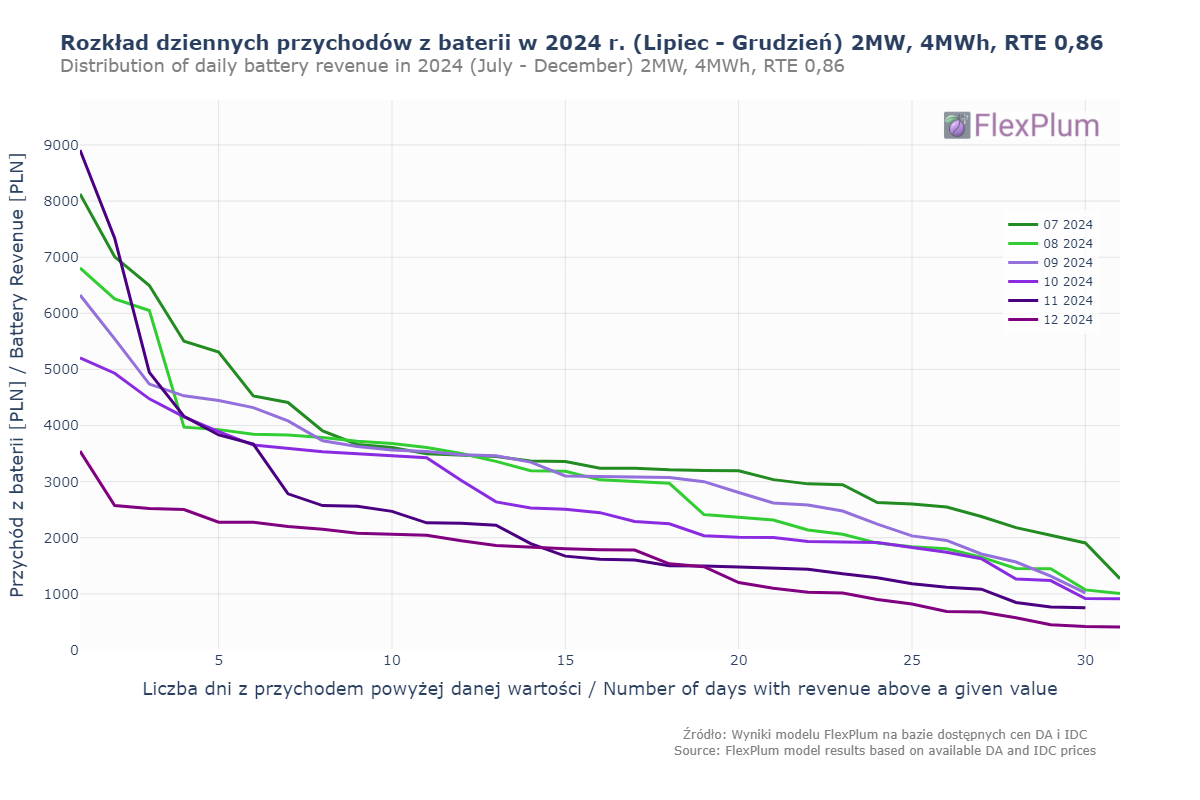

The revenues of our model battery after the Balancing Market reform in June 2024 by month

In our last post we showed that the Balancing Market reform has created favourable conditions for flexible sources such as energy storage…

FlexPlum Team

•

January 21, 2025

© 2025 FlexPlum. All rights reserved.